Blog

Research Articles

Regime-Switching Macro Models

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text

Finacial Sectors and the Macroeconomy

The Nexus of Monetary Policy and Shadow Banking in China (with Chen and Ren)

The Chinese Economy

The Nexus of Monetary Policy and Shadow Banking in China (with Chen and Ren)

The Chinese Economy

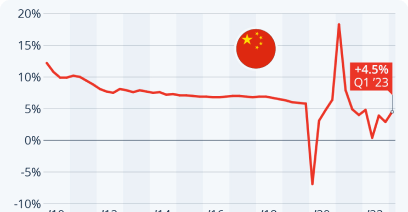

Constructing Quarterly Chinese Time Series Usable for Macroeconomic Analysis

BY KAIJI CHEN, Patrick Higgins, AND TAO ZHA

Abstract During episodes such as the global financial crisis and the Covid-19 pandemic, China experienced

notable fluctuations in its GDP growth and key expenditure components. To explore the primary

sources of these fluctuations, we construct a comprehensive dataset of GDP and its components in

both nominal and real terms at a quarterly frequency. Applying two SVAR models to this dataset,

we uncover the principal drivers of China’s economic fluctuations across different episodes. In

particular, our findings reveal the stark and enduring impacts of consumption-constrained shocks

on GDP and all of its components, especially household consumption, both during and in the

aftermath of the COVID-19 pandemic.

BY KAIJI CHEN, JUE REN, AND TAO ZHA

Abstract We estimate the quantity-based monetary policy system in China. We argue that China’s rising shadow banking was inextricably linked to banks’ \emph{balance-sheet} risk and hampered the effectiveness of monetary policy on the banking system during the 2009-2015 period of monetary policy contractions. By constructing two micro datasets at the individual bank level, we substantiate this argument with three empirical findings: (1) in response to monetary policy tightening, nonstate banks actively engaged in intermediating shadow banking products; (2) these banks, in sharp contrast to state banks, brought shadow banking products onto the balance sheet via risky investments; (3) bank loans and risky investment assets in the banking system respond in opposite directions to monetary policy tightening, which makes monetary policy less effective. We build a theoretical framework to derive the above testable hypotheses and explore implications of the interaction between monetary and regulatory policies.

FORECASTING CHINA’S ECONOMIC GROWTH AND INFLATION

(China Economic Review, 2016, volume 41, pages 46-61)

BY PATRICK HIGGINS, TAO ZHA, AND KAREN ZHONG

Abstract Although macroeconomic forecasting forms an integral part of the policymaking process, there has been a serious lack of rigorous and systematic research in the evaluation of out-of-sample model-based forecasts of China’s real GDP growth and CPI inflation. This paper fills this research gap by providing a replicable forecasting model that beats a host of other competing models when measured by root mean square errors, especially over long-run forecast horizons. The model is shown to be capable of predicting turning points and to be usable for policy analysis under different scenarios. It predicts that China’s future GDP growth will be of L-shape rather than U-shape.

CHINA’S GROWTH PROSPECTS: DISCUSSION OF LOREN BRANDT’S PAPER

(for the November 19-20, 2015 “Policy Challenges in a Diverging Global Economy” conference hosted by the Federal Reserve Bank of San Francisco)

BY TAO ZHA

CHINA’S MACROECONOMIC TIME SERIES: METHODS AND IMPLICATIONS

(Very Preliminary)

BY PATRICK HIGGINS AND TAO ZHA

Abstract We show how to construct a core set of macroeconomic time series usable for studying China’s macroeconomy systematically. When applicable, we document our construction methods in comparison to other existing approaches.

TRENDS AND CYCLES IN CHINA’S MACROECONOMY

(NBER Macroeconomics Annual, 2016, volume 30, pages 1-84)

BY CHUN CHANG, KAIJI CHEN, DANIEL F. WAGGONER, AND TAO ZHA

Abstract We make four contributions in this paper. First, we provide a core of macroeconomic time series usable for systematic research on China. Second, we document, through various empirical methods, the robust findings about striking patterns of trend and cycle. Third, we build a theoretical model that accounts for these facts. Fourth, the model’s mechanism and assumptions are corroborated by institutional details, disaggregated data, and banking time series, all of which are distinctive of Chinese characteristics. We argue that preferential credit policy for promoting heavy industries accounts for the unusual cyclical patterns as well as the post-1990s economic transition featured by the persistently rising investment rate, the declining labor income share, and a growing foreign surplus. The departure of our theoretical model from standard ones offers a constructive framework for studying China’s modern macroeconomy.

A non-technical description of this paper, published by VoxEU.org (CEPR’s policy portal), appears in a Vox column.

Financial Sectors and the Macroeconomy

BY KAIJI CHEN, JUE REN, AND TAO ZHA

Abstract We estimate the quantity-based monetary policy system in China. We argue that China’s rising shadow banking was inextricably linked to banks’ \emph{balance-sheet} risk and hampered the effectiveness of monetary policy on the banking system during the 2009-2015 period of monetary policy contractions. By constructing two micro datasets at the individual bank level, we substantiate this argument with three empirical findings: (1) in response to monetary policy tightening, nonstate banks actively engaged in intermediating shadow banking products; (2) these banks, in sharp contrast to state banks, brought shadow banking products onto the balance sheet via risky investments; (3) bank loans and risky investment assets in the banking system respond in opposite directions to monetary policy tightening, which makes monetary policy less effective. We build a theoretical framework to derive the above testable hypotheses and explore implications of the interaction between monetary and regulatory policies.

ASSESSING THE MACROECONOMIC IMPACT OF BANK INTERMEDIATION SHOCKS: A STRUCTURAL APPROACH

BY KAIJI CHEN AND TAO ZHA

Abstract We take a structural approach to assessing the empirical importance of shocks to the supply of bank-intermediated credit in affecting macroeconomic fluctuations. First, we develop a theoretical model to show how credit supply shocks can be transmitted into disruptions in the production economy. Second, we utilize the unique micro banking data to identify and support the model’s key mechanism. Third, we find that the output effect of credit supply shocks is not only economically and statistically significant but also consistent with the VAR evidence. Our mode estimation indicates that a negative one-standard-deviation shock to credit supply generates a loss of output by one percent.

LIQUIDITY PREMIA, PRICE-RENT DYNAMICS, AND BUSINESS CYCLES

(NBER Working Paper 20377, August 2014)

BY JIANJUN MIAO, PENGFEI WANG, AND TAO ZHA

Abstract In the U.S. economy over the past twenty five years, house prices exhibit fluctuations considerably larger than house rents and these large fluctuations tend to move together with business cycles. We build a simple theoretical model to characterize these observations by showing the tight connection between price-rent fluctuation and the liquidity constraint faced by productive firms. After developing economic intuition for this result, we estimate a medium-scale dynamic general equilibrium model to assess the empirical importance of the role the price-rent fluctuation plays in the business cycle. According to our estimation, a shock that drives most of the price-rent fluctuation explains 30% of output fluctuation over a six-year horizon.

(Journal of Monetary Economics, vol. 80, June 2016, pages 86-105)

BY ZHENG LIU, JIANJUN MIAO, AND TAO ZHA

Abstract We integrate the housing market and the labor market in a dynamic general equilibrium model with credit and search frictions. We argue that the labor channel, combined with the standard credit channel, provides a strong transmission mechanism that can deliver a potential solution to the Shimer (2005) puzzle. The model is confronted with U.S. macroeconomic time series. The estimation results account for two prominent facts observed in the data. First, land prices and unemployment move in opposite directions over the business cycle. Second, a shock that moves land prices also generates the observed large volatility of unemployment.

LAND-PRICE DYNAMICS AND MACROECONOMIC FLUCTUATIONS (Econometrica, vol. 81, no. 3, May, 2013, pages 1147-1184) Formerly entitled “Do Credit Constraints Amplify Macroeconomic Fluctuations?“

BY ZHENG LIU, PENGFEI WANG, AND TAO ZHA

For the Dynare 4.2 code, click on DynareCode4LWZpaper.zip. For the C/C++code, click on C_Cpp_Library4LWZpaper.zip.

For supplemental appendices, click on SupplementalMaterial.zip.

Abstract We argue that positive co-movements between land prices and business investment are a driving force behind the broad impact of land-price dynamics on the macroeconomy. We develop an economic mechanism that captures the co-movements by incorporating two key features into a DSGE model: We introduce land as a collateral asset in firms’ credit constraints and we identify a shock that drives most of the observed fluctuations in land prices. Our estimates imply that these two features combine to generate an empirically important mechanism that amplifies and propagates macroeconomic fluctuations through the joint dynamics of land prices and business investment.

Learning and Escape Dynamics

LEARNING, ADAPTIVE EXPECTATIONS, AND TECHNOLOGY SHOCKS

(Economic Journal, February 2009, volume 119, issue 536, pages 377-405)

BY KEVIN HUANG, ZHENG LIU, AND TAO ZHA

Abstract When rational expectations are replaced by adaptive expectations, we prove that the self-confirming equilibrium is the same as the steady state rational expectations equilibrium, but that dynamics around the steady state are substantially different between the two equilibria. We show that, in contrast to Williams(2003), the differences are driven mainly by the lack of the wealth effect and the strengthening of the intertemporal substitution effect, not by escapes. As a result, adaptive expectations substantially alter the amplification and propagation mechanisms and allow technology shocks to exert much more impact on macroeconomic variables than do rational expectations.

THE CONQUEST OF SOUTH AMERICAN INFLATION

(Journal of Political Economy, 2009, volume 117, number 2, pages 211-256)

BY THOMAS SARGENT, NOAH WILLIAMS, AND TAO ZHA

Abstract We infer determinants of Latin American hyperinflations and stabilizations by using the method of maximum likelihood to estimate a hidden Markov model that potentially assigns roles both to fundamentals in the form of government deficits that are financed by money creation and to destabilizing expectations dynamics that can occasionally divorce inflation from fundamentals. Our maximum likelihood estimates allow us to interpret observed inflation rates in terms of variations in the deficits, sequences of shocks that trigger temporary episodes of expectations driven hyperinflations, and occasional superficial reforms that cut inflation without reforming deficits. Our estimates also allow us to infer the deficit adjustments that seem to have permanently stabilized inflation processes.

BAYESIAN ECONOMETRICS OF LEARNING MODELS

BY TAO ZHA

Abstract Lecture notes for the October 2005 Dynare workshop on learning and monetary policy.

SHOCKS AND GOVERNMENT BELIEFS: THE RISE AND FALL OF AMERICAN INFLATION

(American Economic Review, September 2006, vol 96, no 4, pages 1193-1224)

BY THOMAS SARGENT, NOAH WILLIAMS, AND TAO ZHA

For the program C source code, click on here

Abstract We use a Bayesian Markov Chain Monte Carlo algorithm jointly to estimate the parameters of a `true’ data generating mechanism and those of a sequence of approximating models that a monetary authority uses to guide its decisions. Gaps between a true expectational Phillips curve and the monetary authority’s approximating non-expectational Phillips curve models unleash inflation that a monetary authority that knows the true model would avoid. A sequence of dynamic programming problems implies that the monetary authority’s inflation target evolves as its estimated Phillips curve moves. Our estimates attribute the rise and fall of post WWII inflation in the US to an intricate interaction between the monetary authority’s beliefs and economic shocks. Shocks in the 1970s made the monetary authority perceive a tradeoff between inflation and unemployment that ignited big inflation. The monetary authority’s beliefs about the Phillips curve changed in ways that account for Volcker’s conquest of US inflation.

Regime-Switching Macro Models

PERTURBATION METHODS FOR MARKOV-SWITCHING DYNAMIC STOCHASTIC GENERAL EQUILIBRIUM MODELS

(Quantitative Economics, 2016, vol 7, pages 637-669)

BY ANDREW FOERSTER, JUAN RUBIO-RAMIREZ, DANIEL F. WAGGONER, AND TAO ZHA

Abstract Markov-switching DSGE (MSDSGE) modeling has become a growing body of literature on economic and policy issues related to structural shifts. This paper develops a general perturbation methodology for constructing high-order approximations to the solutions of MSDSGE models. Our new method, called “the partition perturbation method,” partitions the Markov-switching parameter space to keep a maximum number of time-varying parameters from perturbation. For this method to work in practice, we show how to reduce the potentially intractable problem of solving MSDSGE models to the manageable problem of solving a system of quadratic polynomial equations. This approach allows us to first obtain all the solutions and then determine how many of them are stable. We illustrate the tractability of our methodology through two revealing examples.

SOURCES OF MACROECONOMIC FLUCTUATIONS: A REGIME-SWITCHING DSGE APPROACH

(Quantitative Economics, 2011, volume 2, pages 251-301)

BY ZHENG LIU, DANIEL F. WAGGONER, AND TAO ZHA

For technical appendices, click on Technicalapps.zip.

Abstract We examine the sources of macroeconomic economic fluctuations by estimating a variety of richly parameterized DSGE models within a unified framework that incorporates regime switching both in shock variances and in the inflation target. We propose an efficient methodology for estimating regime-switching DSGE models. Our counterfactual exercises show that changes in the inflation target are not the main driving force of high inflation in the 1970s. The model that best fits the U.S. time-series data is the one with synchronized shifts in shock variances across two regimes and the fit does not rely on strong nominal rigidities. We provide evidence that a shock to the capital depreciation rate, which resembles a financial shock, plays a crucial role in accounting for macroeconomic fluctuations.

MINIMAL STATE VARIABLE SOLUTIONS TO MARKOV-SWITCHING RATIONAL EXPECTATIONS MODELS

(Journal of Economic and Dynamic Control, 2011, volume 35, number 12, pages 2150-2166)

BY ROGER E. A. FARMER, DANIEL F. WAGGONER, AND TAO ZHA

Abstract We develop a new method for deriving minimal state variable (MSV) equilibria of a general class of Markov switching rational expectations models and a new algorithm for computing these equilibria. We compare our approach to previously known algorithms, and we demonstrate that ours is both efficient and more reliable than previous methods in the sense that it is able to find MSV equilibria that previously known algorithms cannot. Further, our algorithm can find all possible MSV equilibria in models. This feature is essential if one is interested in using a likelihood based approach to estimation.

UNDERSTANDING REGIME-SWITCHING RATIONAL EXPECTATIONS MODELS

(Journal of Economic Theory, 2009, volume 144, pages 1849-1867)

BY ROGER E. A. FARMER, DANIEL F. WAGGONER, AND TAO ZHA

Abstract We develop a set of necessary and sufficient conditions for equilibria to be determinate in a class of forward-looking Markov-switching rational expectations models and we develop an algorithm to check these conditions in practice. We use three examples, based on the new-Keynesian model of monetary policy, to illustrate our technique. Our work connects applied econometric models of Markov-switching with forward looking rational expectations models and allows an applied researcher to construct the likelihood function for models in this class over a parameter space that includes a determinate region and an indeterminate region.

GENERALIZING THE TAYLOR PRINCIPLE: COMMENT

(American Economic Review, 2010 (March), volume 100, issue 1, pages 608-617)

BY ROGER E. A. FARMER, DANIEL F. WAGGONER, AND TAO ZHA

Abstract Davig and Leeper (2007) have proposed a condition they call the \emph{generalized Taylor principle} to rule out indeterminate equilibria in a version of the new-Keynesian model where the parameters of the policy rule follow a Markov-switching process. We show that although their condition rules out a subset of indeterminate equilibria, it does not establish uniqueness of the fundamental equilibrium. We discuss the differences between indeterminate fundamental equilibria included by Davig and Leeper’s condition and fundamental equilibria that their condition misses. JEL E40, E52, Taylor principle, indeterminacy, Markov switching.

ASYMMETRIC EXPECTATION EFFECTS OF REGIME SWITCHES IN MONETARY POLICY

(Review of Economic Dynamics, 2009 (April), volume 12, number 2, pages 284-303)

BY ZHENG LIU, DAN WAGGONER, TAO ZHA

Abstract This paper addresses two substantive issues: (1) Does the magnitude of the expectation effect of regime switching in monetary policy depend on a particular policy regime? (2) Under which regime is the expectation effect quantitatively important? Using two canonical DSGE models, we show that there exists asymmetry in the expectation effect across regimes. The expectation effect under the dovish policy regime is quantitatively more important than that under the hawkish regime. These results suggest that the possibility of regime shifts in monetary policy can have important effects on rational agents’ expectation formation and on equilibrium dynamics. They offer a theoretical explanation for the empirical possibility that a policy shift from the dovish regime to the hawkish regime may not be the main source of substantial reductions in the volatilities of inflation and output.

INDETERMINACY IN A FORWARD LOOKING REGIME SWITCHING MODEL

(International Journal of Economic Theory (a special issue in honor of Jess Benhabib), 2009, volume 5, pages 69-84)

BY ROGER E. A. FARMER, DANIEL F. WAGGONER, AND TAO ZHA

Abstract This paper is about the properties of Markov switching rational expectations (MSRE) models. We present a simple monetary policy model that switches between two regimes with known transition probabilities. The first regime, treated in isolation, has a unique determinate rational expectations equilibrium and the second contains a set of indeterminate sunspot equilibria. We show that the Markov switching model, which randomizes between these two regimes, may contain a continuum of indeterminate equilibria. We provide examples of stationary sunspot equilibria and bounded sunspot equilibria which exist even when the MSRE model satisfies a ‘generalized Taylor principle’. Our result suggests that it may be more difficult to rule out non-fundamental equilibria in MRSE models than in the single regime case where the Taylor principle is known to guarantee local uniqueness.

WERE THERE REGIME SWITCHES IN US MONETARY POLICY?

(American Economic Review, March 2006, volume 96, number 1, pages 54-81)

BY CHRISTOPHER A. SIMS AND TAO ZHA

Abstract A multivariate model, identifying monetary policy and allowing for simultaneity and regime switching in coefficients and variances, is confronted with US data since 1959. The best fit is with a version that allows time variation in structural disturbance variances only. Among versions that allow for changes in equation coefficients also, the best fit is for a one that allows coefficients to change only in the monetary policy rule. That version allows switching among three main regimes and one rarely and briefly occurring regime. The three main regimes correspond roughly to periods when most observers believe that monetary policy actually differed, but the differences among regimes are not large enough to account for the rise, then decline, in inflation of the 70’s and 80’s. In versions that insist on changes in the policy rule, the estimates imply monetary targeting was central in the early 80’s, but also important sporadically in the 70’s.

(Journal of Monetary Economics, 2003, vol 50, no 8, pp. 1673-1700)

BY ERIC M. LEEPER AND TAO ZHA

Abstract We present a theoretical and empirical framework for computing and evaluating linear projections conditional on hypothetical paths of monetary policy. A modest policy intervention does not significantly shift agents’ beliefs about policy regime and does not induce the changes in behavior that Lucas (1976) emphasizes. Applied to an econometric model of U.S. monetary policy, we find that a rich class of interventions routinely considered by the Federal Reserve is modest and their impacts can be reliably forecasted by an identified linear model. Modest interventions can shift projected paths and probability distributions of macro variables in economically meaningful ways.

Econometric Theory and Application

STRUCTURAL VECTOR AUTOREGRESSIONS: THEORY OF IDENTIFICATION AND ALGORITHMS FOR INFERENCE

(Review of Economic Studies, 2010 (April), volume 77, issue 2, pages 665-696)

By JUAN RUBIO-RAMIREZ, DAN WAGGONER, AND TAO ZHA

Abstract SVARs are widely used for policy analysis and to provide stylized facts for dynamic general equilibrium models. Yet there have been no workable rank conditions to ascertain whether an SVAR is globally identified. When identifying restrictions, such as long-run restrictions, are imposed on impulse responses, there have been no efficient algorithms for small-sample estimation and inference. To fill these important gaps in the literature, this paper makes four contributions. First, we establish general rank conditions for global identification of both overidentified and exactly identified models. Second, we show that these conditions can be checked as a simple matrix-filling exercise and that they apply to a wide class of identifying restrictions, including linear and certain nonlinear restrictions. Third, we establish a very simple rank condition for exactly identified models that amounts to a straightforward counting exercise. Fourth, we develop a number of efficient algorithms for small-sample estimation and inference.

BLOCK RECURSION AND STRUCTURAL VECTOR AUTOREGRESSIONS

(Journal of Econometrics, 1999, vol 90, pp. 291-316)

BY TAO ZHA

Abstract In applications of structural VAR modeling, finite-sample properties may be difficult to obtain when certain identifying restrictions are imposed on lagged relationships. As a result, even though imposing some lagged restrictions makes economic sense, lagged relationships are often left unrestricted to make statistical inference more convenient. This paper develops block Monte Carlo methods to obtain both maximum likelihood estimates and exact Bayesian inference when certain types of restrictions are imposed on the lag structure. These methods are applied to two examples to illustrate the importance of imposing restrictions on lagged relationships.

DYNAMIC STRIATED METROPOLIS-HASTINGS SAMPLER FOR HIGH-DIMENSIONAL MODELS

(Journal of Econometrics, February 2016, vol. 192, pages 406-420)

BY DANIEL F. WAGGONER, HONGWEI WU, AND TAO ZHA

Abstract Having efficient and accurate samplers for simulating the posterior distribution is crucial for Bayesian analysis. We develop a generic posterior simulator called the “dynamic striated Metropolis-Hastings (DSMH)” sampler. Grounded in the Metropolis-Hastings algorithm, it pools the strengths from the equi-energy and sequential Monte Carlo samplers while avoiding the weaknesses of the standard Metropolis-Hastings algorithm and those of importance sampling. In particular, the DSMH sampler possesses the capacity to cope with extremely irregular distributions that contain winding ridges and multiple peaks; and it is robust to how the sampling procedure progresses across stages. The high-dimensional application studied in this paper provides a natural platform for testing any generic sampler.

CONFRONTING MODEL MISSPECIFICATION IN MACROECONOMICS

(Journal of Econometrics, December 2012, volume 171, issue 2, pages 167-184 )

BY DANIEL F. WAGGONER AND TAO ZHA

Abstract We confront model misspecification in macroeconomics by proposing an analytic framework for merging multiple models. This framework allows us to 1) address uncertainty about models and parameters simultaneously and 2) trace out the historical periods in which one model dominates other models. We apply the framework to a richly parameterized DSGE model and a corresponding BVAR model. The merged model, fitting the data better than both individual models, substantially alters economic inferences about the DSGE parameters and about the implied impulse responses.

CONDITIONAL FORECASTS IN DYNAMIC MULTIVARIATE MODELS

(Review of Economics and Statistics, 1999, vol 81 (no 4), pp. 639-651)

BY DANIEL F. WAGGONER AND TAO ZHA

Abstract In the existing literature, conditional forecasts in the vector autoregressive (VAR) framework have not been commonly presented with probability distributions (densities). This paper develops Bayesian methods for computing the exact finite-sample distribution of conditional forecasts. It broadens the class of conditional forecasts to which the methods can be applied. The methods work for both structural and reduced-form VAR models and, in contrast to common practices, account for parameter uncertainty in finite samples. Empirical examples under both a flat prior and a reference prior are provided to show the use of these methods.

METHODS FOR INFERENCE IN LARGE MULTIPLE-EQUATION MARKOV-SWITCHING MODELS

(Journal of Econometrics, 2008, volume 146, issue 2, pages 255-274)

BY CHRISTOPHER A. SIMS, DANIEL F. WAGGONER, AND TAO ZHA

Abstract Inference for hidden Markov chain models in which the structure is a multiple-equation macroeconomic model raises a number of difficulties that are not as likely to appear in smaller models. One is likely to want to allow for many regimes in the Markov chain, without allowing the number of free parameters in the transition matrix to grow as the square as the number of regimes, but also without losing a convenient form for the posterior distribution of the transition matrix. Calculation of marginal data densities for assessing model fit is often difficult in high-dimensional models, and seems particularly difficult in these models. This paper gives a detailed explanation of methods for maximizing posterior density and initiating MCMC simulations that provide some robustness against the complex shape of the likelihood in these models. These difficulties and remedies are likely to be useful generally for Bayesian inference in large time series models.

LOCAL AND GLOBAL IDENTIFICATION OF DSGE MODELS: A SIMULTANEOUS-EQUATION APPROACH

By MARTIN FUKAC, DAN WAGGONER, AND TAO ZHA

Abstract We address some issues about local and global identification of DSGE models and link these issues to identification in the simultaneous-equation VAR framework.

MCMC METHOD FOR MARKOV MIXTURE SIMULTANEOUS-EQUATION MODELS: A NOTE

BY CHRISTOPHER A. SIMS AND TAO ZHA

(If you are unable to download this paper, click here)

Abstract This paper extends the existing MCMC simulation methods to a system of simultaneous equations with hidden Markov chains. It overcomes analytical and computational difficulties that arise when one restricts the degree of time variation on the system. We derive the probability density functions of conditional posterior distributions used for the MCMC simulations and develope software that enables one to obtain the solution on a standard PC desktop. Sims and Zha 2004 have applied this method to addressing various questions regarding monetary policy. Despite intensive computation needed to get reliable results, we hope that further innovations in numerical methods and computer technology will make our method easier for applied researchers to use.

(Econometric Reviews, 2007, vol 26, no 2-4, pp. 221-252)

BY JAMES D. HAMILTON, DANIEL F. WAGGONER, AND TAO ZHA

Abstract The issue of normalization arises whenever two different values for a vector of unknown parameters imply the identical economic model. A normalization implies not just a rule for selecting which among equivalent points to call the MLE, but also governs the topography of the set of points that go into a small-sample confidence interval associated with that MLE. A poor normalization can lead to multimodal distributions, disjoint confidence intervals, and very misleading characterizations of the true statistical uncertainty. This paper introduces the identification principle as a framework upon which a normalization should be imposed, according to which the boundaries of the allowable parameter space should correspond to loci along which the model is locally unidentified. We illustrate these issues with examples taken from mixture models, structural VARs, and cointegration.

(The New Palgrave Dictionary of Economics, 2nd Edition, (eds) Blume and Durlauf, eds.)

BY TAO ZHA

Abstract Vector autoregressions are a class of dynamic multivariate models introduced by Sims (1980) to macroeconomics. These models have been primarily used to bring empirical regularities out of the time series data, to provide forecasting and policy analysis, and to serve as a benchmark for model comparison. Economic applications often impose more restrictions on vector autoregressions than originally thought necessary. Recent econometric developments have made it feasible to handle vector autoregressions with a wide class of restrictions and have narrowed the gap between these models and dynamic stochastic general equilibrium models.

Other Macroeconomic Papers

CONDITIONAL FORECASTS IN DYNAMIC MULTIVARIATE MODELS

(Review of Economics and Statistics, 1999, vol 81 (no 4), pp. 639-651)

BY DANIEL F. WAGGONER AND TAO ZHA

Abstract In the existing literature, conditional forecasts in the vector autoregressive (VAR) framework have not been commonly presented with probability distributions (densities). This paper develops Bayesian methods for computing the exact finite-sample distribution of conditional forecasts. It broadens the class of conditional forecasts to which the methods can be applied. The methods work for both structural and reduced-form VAR models and, in contrast to common practices, account for parameter uncertainty in finite samples. Empirical examples under both a flat prior and a reference prior are provided to show the use of these methods.