Bio

About Tao Zha

Tao Zha is research center executive director of the Center for Quantitative Economic Research in the research department of the Federal Reserve Bank of Atlanta, Samuel Candler Dobbs professor of economics at Emory University, and research associate at the National Bureau of Economic Research (NBER).

Tao Zha is research center executive director of the Center for Quantitative Economic Research in the research department of the Federal Reserve Bank of Atlanta, Samuel Candler Dobbs professor of economics at Emory University, and Research Associate at National Bureau of Economic Research (NBER). His major fields of study are macroeconomics, financial economics, econometrics, and the Chinese economy.

Dr. Zha was born in 1962. He received his doctorate in economics from the University of Minnesota in December 1992. His major fields of study are macroeconomics, financial economics,

Data

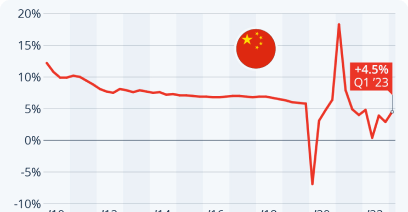

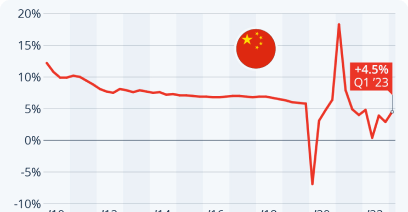

Data for China's Macroeconomy

The time series dataset for the NBER Macroeconomics Annual 2016 paper “Trends and Cycles in China’s Macroeconomy” by Chang, Chen, Waggoner, and Zha and the manuscript “China’s Macroeconomic Time Series: Methods and Implications” by Higgins and Zha. Please consult readme data for instructions of how to use this dataset. For the April 2015 vintage dataset, it can be downloaded at the NBER website. For an updated and expanded dataset, you can download it at the CQER website of the Federal Reserve Bank of Atlanta.

Code

Computer Code

MATLAB code for the forthcoming American Economic Review article “The Nexus of Monetary Policy and Shadow Banking in China” along with readme files:

- The panel SVAR can be downloaded from PanelSVAR.

- Estimation of the switching monetary policy rule and exogenous monetary policy shocks can be downloaded from the zip file MatlabCodeEstMP_tv.

- Time series of estimated exogenous monetary policy shocks can be downloaded from the Excel/csv format data2016Q2mpshocks.csv or from the Matlab format data2016Q2mpshocks.mat.

Blog

Research Articles

Regime-Switching Macro Models

Structural Vector Autoregressions: Theory of Identification and Algorithms for Inference.

Finacial Sectors and the Macroeconomy

The Nexus of Monetary Policy and Shadow Banking in China.

The Chinese Economy

Constructing Quarterly Chinese Time Series Usable for Macroeconomic Analysis

Regime-Switching Macro Models

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text

Finacial Sectors and the Macroeconomy

The Nexus of Monetary Policy and Shadow Banking in China (with Chen and Ren)

The Chinese Economy

The Nexus of Monetary Policy and Shadow Banking in China (with Chen and Ren)